CoT Report: Speculators Clamor to Buy Gold, Oil Extreme Still Irrelevant

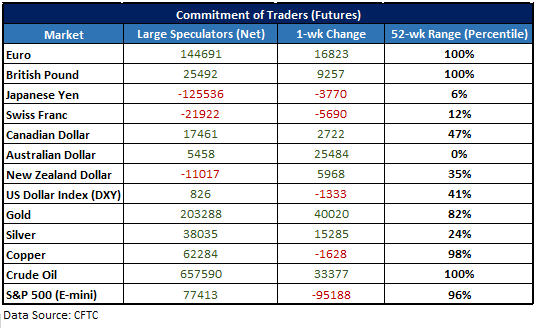

The CoT report is an intermediate to long-term sentiment indicator; for short-term indications see the IG Client Sentiment page.To see how sentiment may tie into our outlook on FX-pairs and markets, see the DailyFX Q1 Forecasts.The most recent Commitment of Traders (CoT) report showed a continuation in aggressive buying of precious metals contracts and a further increase in the record long built up in oil by large speculators.

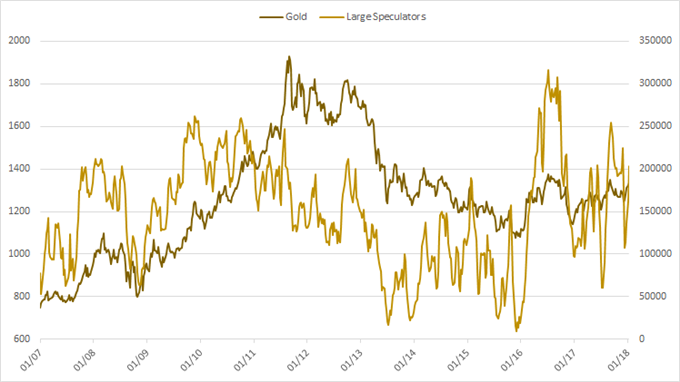

Large speculators continue buying up gold contracts in a big way

Along with the sharp rise in gold we are seeing speculative optimism grow in a substantial way. The most recent report showed large speculators' increase their net-long by 40,020 contracts, a near-record amount, following an increase of 27,320 the week prior. The total position is 203k conctracts, a relatively large amount and registers in the top 20% in terms of size over the past year.What this amounts to at this juncture isn't yet clear, however; with gold at resistance we may see the recent surge in buying come to a pause. How price reacts at the 2013 trend-line or the September high of 1357 could be very telling from an intermediate-term perspective. Will the fresh surge in buying be rewarded, or will we see another set-back unfold? For now, resistance will be respected until we see a breakout and higher-high above 1357.

Gold

Gold: Daily

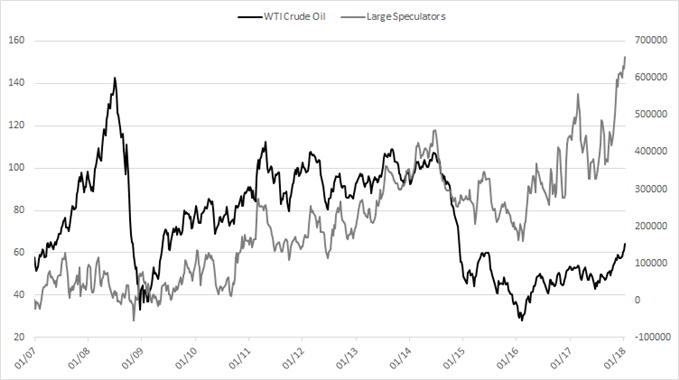

Large oil specs add to record extreme, yet to matter

The massive net-long held by large specs in the oil market continues to become even more massive. The most recent report showed an increase of 33,377 contracts, bringing the net-long to a new record total of 657,590.While the speculative build-up has been viewed as a sign of over bullishness, price action hasn’t backed up the notion that the market has gotten ahead of itself. Until we see a bearish sequence of lower-lows and lower-highs develop, the benefit of the doubt runs with the prevailing upward trend.

Crude Oil

Large speculator profiles for major FX & markets:

some other

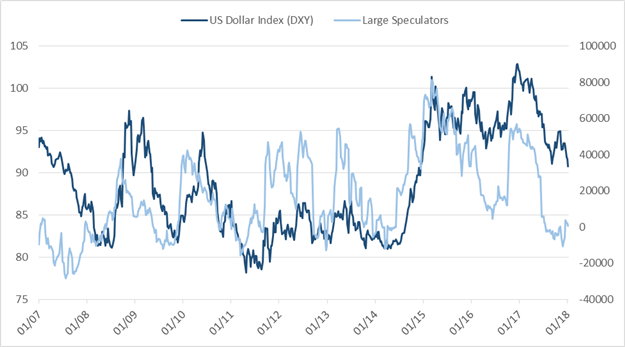

US Dollar Index (DXY)

Euro

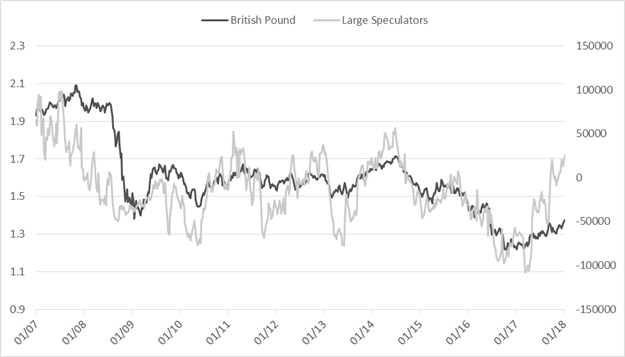

British Pound

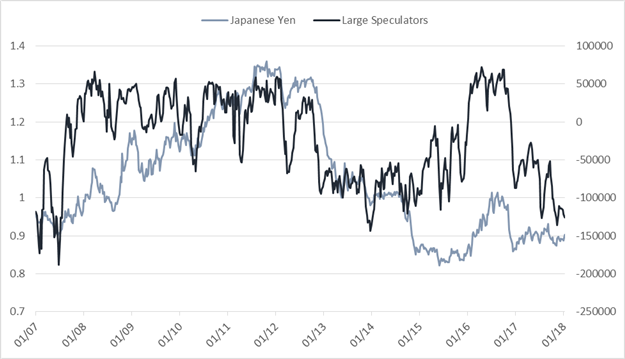

Japanese Yen

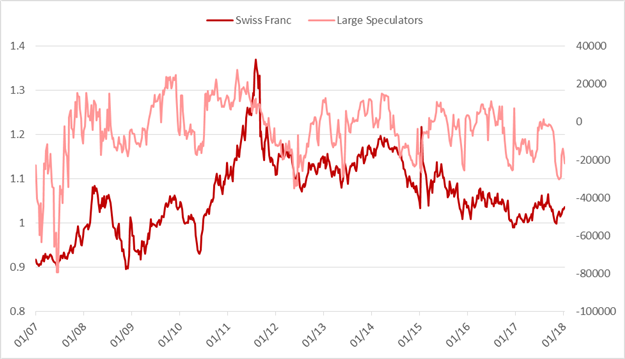

Swiss Franc

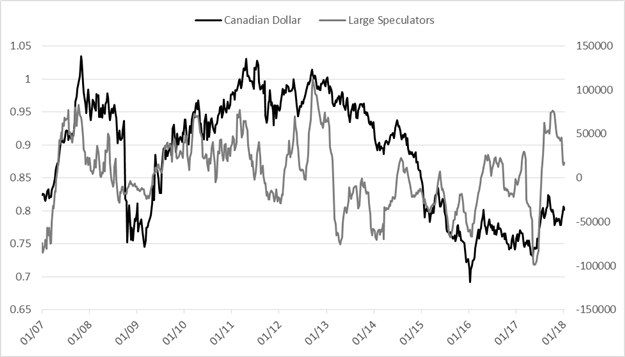

Canadian Dollar

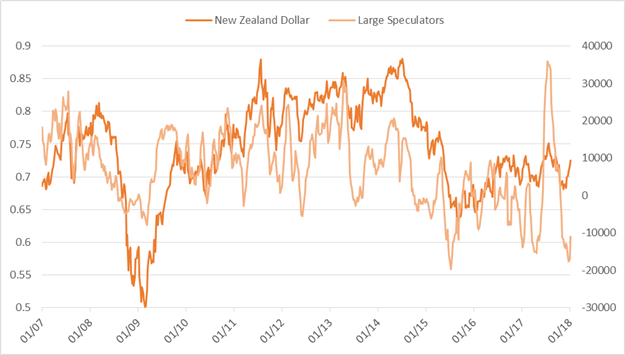

New Zealand Dollar

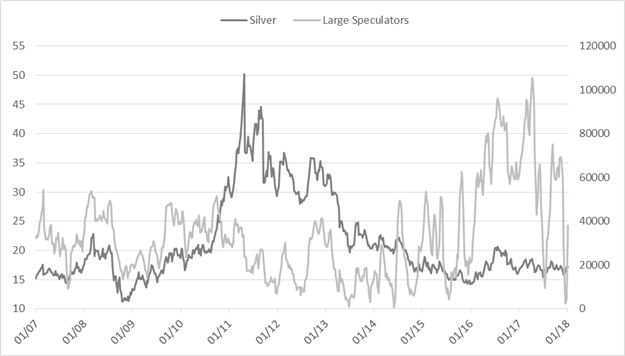

Silver

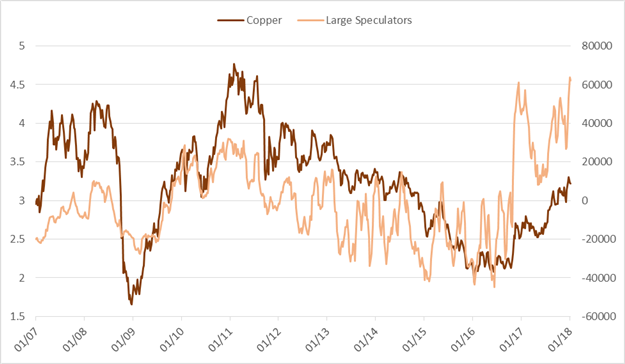

Copper

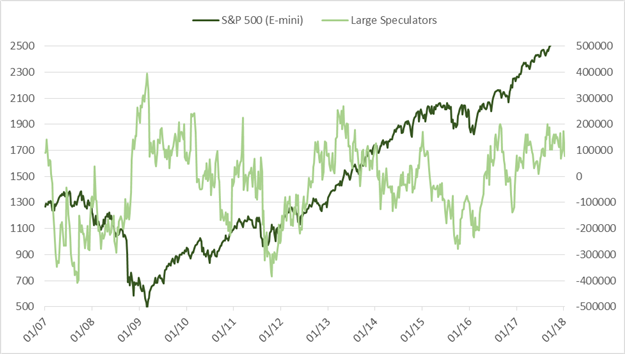

S&P 500 (E-mini)

there is a somekind of research that will help you to trade into the Forex market.

No comments:

Post a Comment