FOREX Daily Analysis:

The US Dollar managed to stop its fall as the US Dollar Index (USDX), which measures the Dollar’s performance against other majour currencies closed 0.12% higher.Gold retreated from its recent high as the Dollar also retreated, while uncertainty about future policy of global central banks remains a concern. Oil could not hold onto its gains ad had the worst trading day of 2018, while Russia’s Energy minister rushed to reassure markets of its commitment to the OPEC production

you must have an edge.cut deal.

US equity indices closed lower, despite on-target earnings of blue chips like Citigroup (NYSE:C) and General Motors (NYSE:GM).

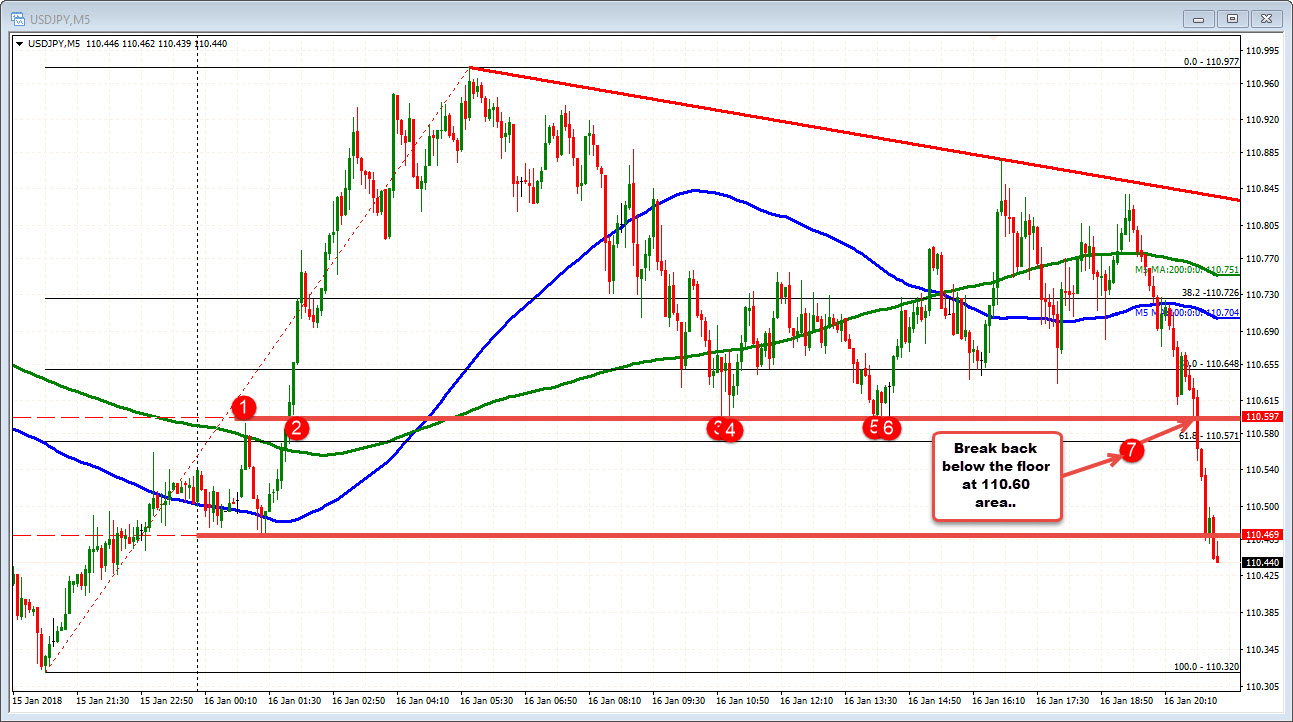

USDJPY trades at session lows:

The broad US stock indices are now in the red and trading near low levels, and that has helped to lead to fall in the USDJPY.

The USDJPY is trading at the lows for the day at 110.46 (was the

low in the early Asia-Pacific session too). The next target is the low

from yesterday at 110.32.

On Wednesday the European Union will release Harmonised Index of

Consumer Prices data. In the US the Mortgage Bankers' Association index

data as well as Redbook Store Sales, Industrial Production and Capacity

Utilization data will be released.

Looking at the daily below, usd/jpy reached a high today of 110.977.

that was just below the 50% retracement of the move up from the september

2017 low. staying below kept the tilt more to the downside from a technical perspective. the next downside target on the daily chart.

No comments:

Post a Comment