daily news and analysis:Forex market

.

Major data releases for today:

At 10:00 GMT, Eurozone Consumer Price Index – Core (YoY) (Dec) will be released. The consensus is for an unchanged value of 1.1%. Consumer Price Index (MoM) (Dec) is expected to be 0.4% from 0.1% previously. Consumer Price Index (YoY) (Dec) is expected to be unchanged at 1.4%. Consumer Price Index – Core (MoM) (Dec) is expected at 0.2% from -0.1% prior. EUR pairs could see volatility pick up due to this data.

At 11:45 GMT, UK MPC Member Saunders is due to speak at the Financial Intermediary and Broker Association inaugural conference in London. GBP crosses could be moved by the comments made during this time.

At 14:15 GMT, US Industrial Production (MoM) (Dec) will be released. The consensus is for 0.4% from 0.2% previously. Capacity Utilization (Dec) is also released at this time with an expectation for 77.3% v 77.1% prior. USD crosses can be impacted.

At 15:00 GMT, US NAHB Housing Market Index (Jan) will be released with an expected reading of 72. The previous reading was 74. This release may affect USD pairs.

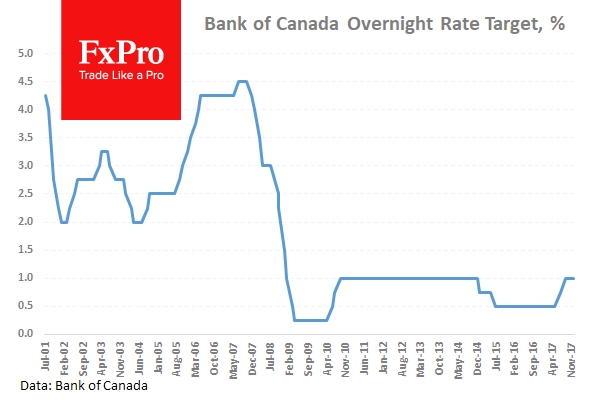

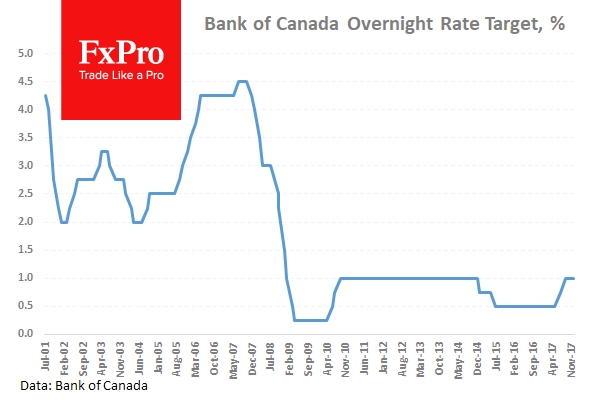

At 15:00, Bank of Canada Rate Statement will be made public. The Monetary Policy Report will be released and the Interest Rate Decision is expected to be 1.25% from 1.00% previously.

At 16:15, Bank of Canada Press Conference based on the decisions made earlier at 15:00 GMT.

At 19:00, US Fed’s Beige Book compiles anecdotal evidence from 12 Federal Reserve Banks regarding their local economic conditions.

At 20:15, US FOMC Member Mester will speak about Monetary Policy Communication at Rutgers University in New Jersey. Comments during the speech and during the following Q&A session afterwards could move USD pairs.

At 23:50, Japanese Foreign Investment in Japanese Stocks (Jan 12) will be released, with a prior reading of ¥597.9B. Foreign Bond Investment (Jan 12) will also be released at this time, with a previous reading of ¥173B.

The BOC is expected to deliver an Interest rate hike of 25bps today as

it seeks to catch up with an economy that is flying high. BOC’s Governor

Poloz will deliver his decision and Press Conference, where he will

outline the factors involved in making the decision.

Chief among them

will be the broad underlying wage growth and strong price dynamics of

the economy, coupled with excesses in the financial system. The Governor

down-played NAFTA concerns in his December speech but as the Trade

negotiations are on-going this week, they will remain a concern for the

economy unless a positive resolution can be found.

The BOC is expected to deliver an Interest rate hike of 25bps today as

it seeks to catch up with an economy that is flying high. BOC’s Governor

Poloz will deliver his decision and Press Conference, where he will

outline the factors involved in making the decision. Chief among them

will be the broad underlying wage growth and strong price dynamics of

the economy, coupled with excesses in the financial system.

The Governor

down-played NAFTA concerns in his December speech but as the Trade

negotiations are on-going this week, they will remain a concern for the

economy unless a positive resolution can be found.

.

Major data releases for today:

At 10:00 GMT, Eurozone Consumer Price Index – Core (YoY) (Dec) will be released. The consensus is for an unchanged value of 1.1%. Consumer Price Index (MoM) (Dec) is expected to be 0.4% from 0.1% previously. Consumer Price Index (YoY) (Dec) is expected to be unchanged at 1.4%. Consumer Price Index – Core (MoM) (Dec) is expected at 0.2% from -0.1% prior. EUR pairs could see volatility pick up due to this data.

At 11:45 GMT, UK MPC Member Saunders is due to speak at the Financial Intermediary and Broker Association inaugural conference in London. GBP crosses could be moved by the comments made during this time.

At 14:15 GMT, US Industrial Production (MoM) (Dec) will be released. The consensus is for 0.4% from 0.2% previously. Capacity Utilization (Dec) is also released at this time with an expectation for 77.3% v 77.1% prior. USD crosses can be impacted.

At 15:00 GMT, US NAHB Housing Market Index (Jan) will be released with an expected reading of 72. The previous reading was 74. This release may affect USD pairs.

At 15:00, Bank of Canada Rate Statement will be made public. The Monetary Policy Report will be released and the Interest Rate Decision is expected to be 1.25% from 1.00% previously.

At 16:15, Bank of Canada Press Conference based on the decisions made earlier at 15:00 GMT.

At 19:00, US Fed’s Beige Book compiles anecdotal evidence from 12 Federal Reserve Banks regarding their local economic conditions.

At 20:15, US FOMC Member Mester will speak about Monetary Policy Communication at Rutgers University in New Jersey. Comments during the speech and during the following Q&A session afterwards could move USD pairs.

At 23:50, Japanese Foreign Investment in Japanese Stocks (Jan 12) will be released, with a prior reading of ¥597.9B. Foreign Bond Investment (Jan 12) will also be released at this time, with a previous reading of ¥173B.

No comments:

Post a Comment