CoT Report:

The CoT report is longer-term sentiment indicator; for short-term sentiment indications seeThe most recent commitment of Traders (cot) report showed large speculators, in most instances, adding to net-positions which are already extreme relative to the past year. seven of the 13 futures contracts highlighted below have position sizes which are in the top or bottom 10%. Last weeks we talked about GBP and gold, this week we'll look at the euro and oil.

Every Friday, the CFTC releases the weekly report showing trader's positioning in the futures market as reported for the week ending on Tuesday in the table below we've outlined key statistics regarding net positioning of large speculators (i.e. hedge funds, CTAs, etc.) This group of traders are largely known to be trend-followers due to the strategies they typically employ, collectively. The direction of their position, magnitude of changes, as well as extremes are taken into consideration when analyzing how their activity could impact future price fluctuations.

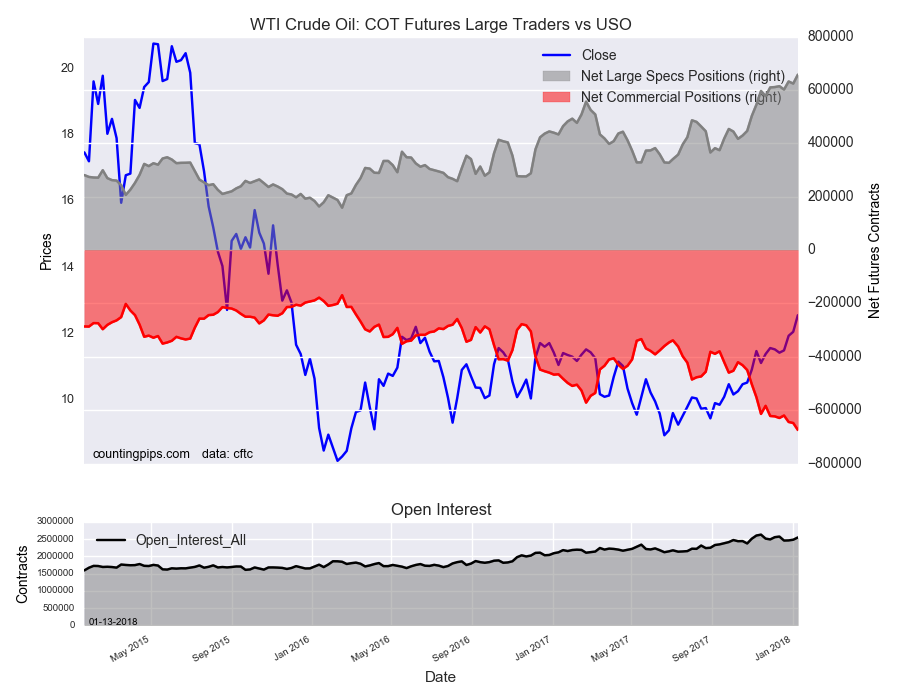

WTI Crude oil commercial positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purpose, totaled a net position of -674,098 contracts on the week. This was a weekly fall of -25,984 contracts from the total net of -648,114 contracts reported the previous week.

Euro large speculators keep adding to long postion

this past week's report showed large trend-followers adding to their net-long for the 6th week out of the past eight. The net-change of 5227 brings the total long positions to 144.7k contracts, another record.while large speculators have a solid track record of successfully idntifying intermediate to long-term trends in the euro, there is reason to believe they could be getting ahead of themselves. Turning to the monthly chart, the euro is at a trend-line extending down from 2008. Big resistance coupled with an extreme level of bullishness could keep EUR/USD from trading higher.

Chart 1 – Euro Positioning

Crude oil speculative positioning continues pushing to new extremes

Large oil traders continue to add to their speculative long, adding another 8908 contract to bring the total to +717k. Just a impressive as the rally has been, so has the addition to the total net-long positioning. Twelve out of the past 15 weeks we have seen an increased in long exposure,and while it is at a record extreme, it has clearly meant nothing in terms of indicating an overbought market.we will continue run with price action first, positioning second. Should we see price action turn bearish (lower lows, lower highs) then an unwinding of longs will be seen as an accelerant to a trends reversal. But until that happens, as they say,"the trends is your friend." There is resistance in the vicinity of 67-71, created during late-2009 through most of 2010; worth keeping an eye on as oil heads into this zone

USO (NYSE:USO):

over the same weekly reporting time-frame, from Tuesday to Tuesday, the USO Crude oil ETF, which tracks the price of WTI crude oil, closed at approximately $12.57 which was a boost of $0.50 from the previous close of

$12.07, according to unofficial market data.

No comments:

Post a Comment